This mod makes the credit system a bit more realistic. However, the standard game credits will be deactivated. If there are still loans running, they will be transferred to the new system.

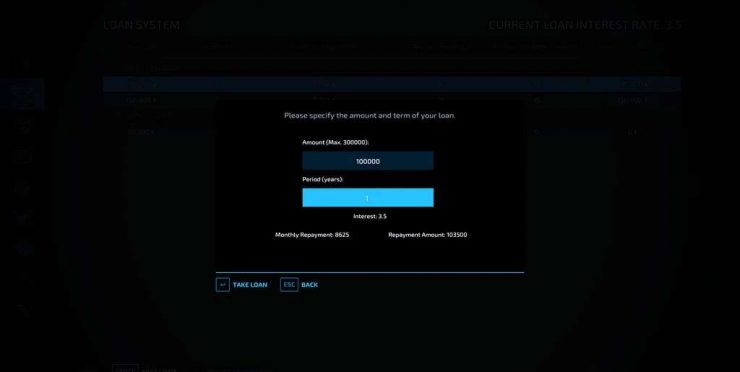

With this system it is possible to take annulment loans. For this, a loan with a fixed amount, a term and a loan interest rate is concluded. This calculates the monthly installment, which is debited at the end of each month.

The bank requires collateral here, so the maximum loan amount is calculated from the current retail value of your vehicles, fields (60%), cash and your existing loans.

To make this a bit more realistic, the loan interest rate can rise, fall or stay the same each month. This makes it all the more crucial when the loan is taken out. However, you can also change this variable loan interest rate to a fixed loan interest rate in the settings.

How does an annulment loan work? Here is a brief explanation:

An annulment loan has an annulity, the monthly rate, and a loan interest rate. This annulity is made up of the repayment amount and the interest amount. The interest amount is calculated by multiplying the loan interest rate by the remaining amount of the loan. As a result, the interest amount keeps decreasing and the repayment amount keeps increasing.